In addition to the mortgage payment you have to make, there are likely other costs associated with being a homeowner that you have to plan for, too.įirst and foremost, you need to plan for the costs you’ll incur when you close on your mortgage.

However, your mortgage is just one factor that affects the total housing costs you incur each month. How Much House Can I Afford Based on Income?Ĭalculating your monthly mortgage payment is important because you want to make sure your home is affordable. Comparing rates from the best lenders to find the most affordable interest rate could make both your monthly payments and total loan costs much more affordable. When you plug your numbers into this formula, the biggest factors that affect the cost of your mortgage payment are the total cost of the home that you’re buying, the amount of your down payment, and the length of the term of your mortgage loan.Ī longer-term loan will significantly reduce your monthly payments since you’ll have years longer to pay your loan balance down to $0-but your total loan costs will be higher due to all the extra interest that you pay over time.īecause you do pay interest for a very long time with any mortgage, even a slight increase in the interest rate can end up costing you thousands of dollars over the life of the loan.īecause the rate you pay can affect your costs so much, you should carefully compare rates from several different lenders before you get a mortgage. So, if you have a 15-year mortgage at a fixed rate, you would multiply 15 x 12 to get 180 total payments You can determine the total number of payments by multiplying the number of years of your mortgage loan by 12 months in a year. n = The total number of payments that you will make over the life of your mortgage loan.If your annual rate was 4.5%, you would divide. To find out what the monthly rate is, you’d divide your annual interest rate by the 12 months of the year. When you get your rate from your lender, it will be expressed as an annual rate. r = The monthly interest rate that you pay on your mortgage loan.P = The principal balance of your mortgage loan, which is the entire loan amount that you are borrowing.Here are what the components of the formula mean: If that looks like Greek to you, don’t worry-the point of the calculator above is so that you won’t have to do this calculation yourself-but it is helpful to know what the number you receive from our calculator truly represents. There is a set formula that can be used to calculate a mortgage loan payment. How Do I Get Prequalified for a Mortgage Loan?.What’s the Necessary Credit Score to Get a Mortgage?.How Much House Can I Afford Based on Income?.

#Home mortgage calculator how to#

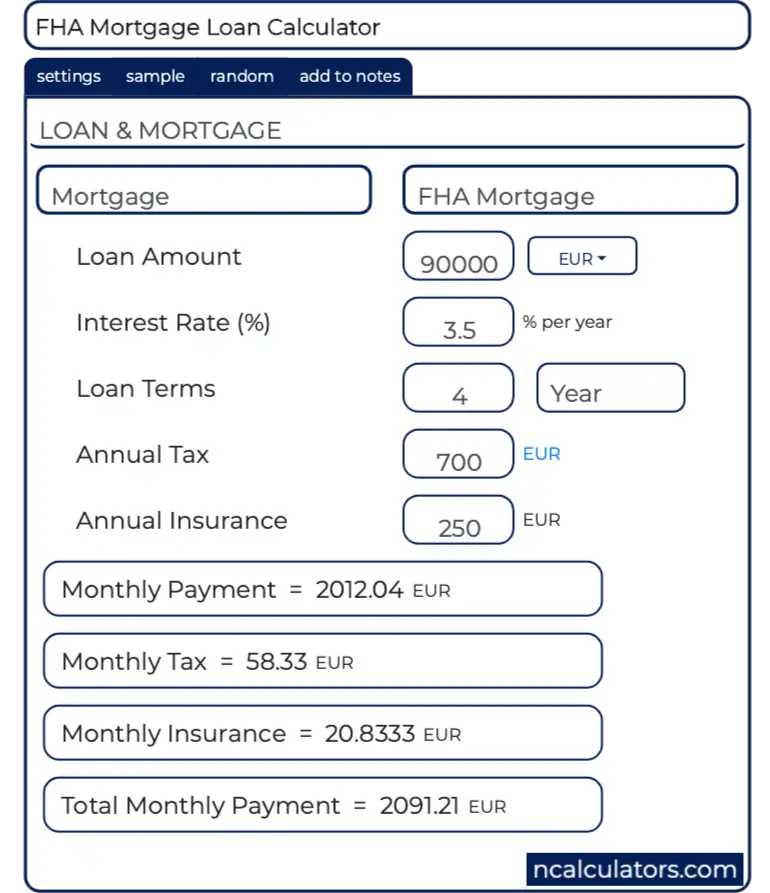

How to Calculate a Mortgage Loan Payment.The calculator will show you the amount that you’d have to pay for your home so you can determine if this can fit into your budget. Just enter your home’s value, the down payment you’re making on the property, and the interest rate. Our mortgage calculator will help you to determine what your monthly payments would look like. This is an important step in double-checking whether you can truly afford your would-be home. Check out reviews from real customers to see which lender has the strongest recommendation scoreīefore you buy a house, you should use a mortgage calculator to determine how much your home will cost per month and how much you’ll pay in total interest.

#Home mortgage calculator free#

0 kommentar(er)

0 kommentar(er)